Whether you are a first-time home buyer looking to (finally!) move out of your parents’ house, or an experienced home buyer interested in downsizing, there are guidelines you should remember as you begin this process. Purchasing a property can be exciting, but if you fail to check certain tasks off your to-do list, or think too far ahead, it can also be stressful.

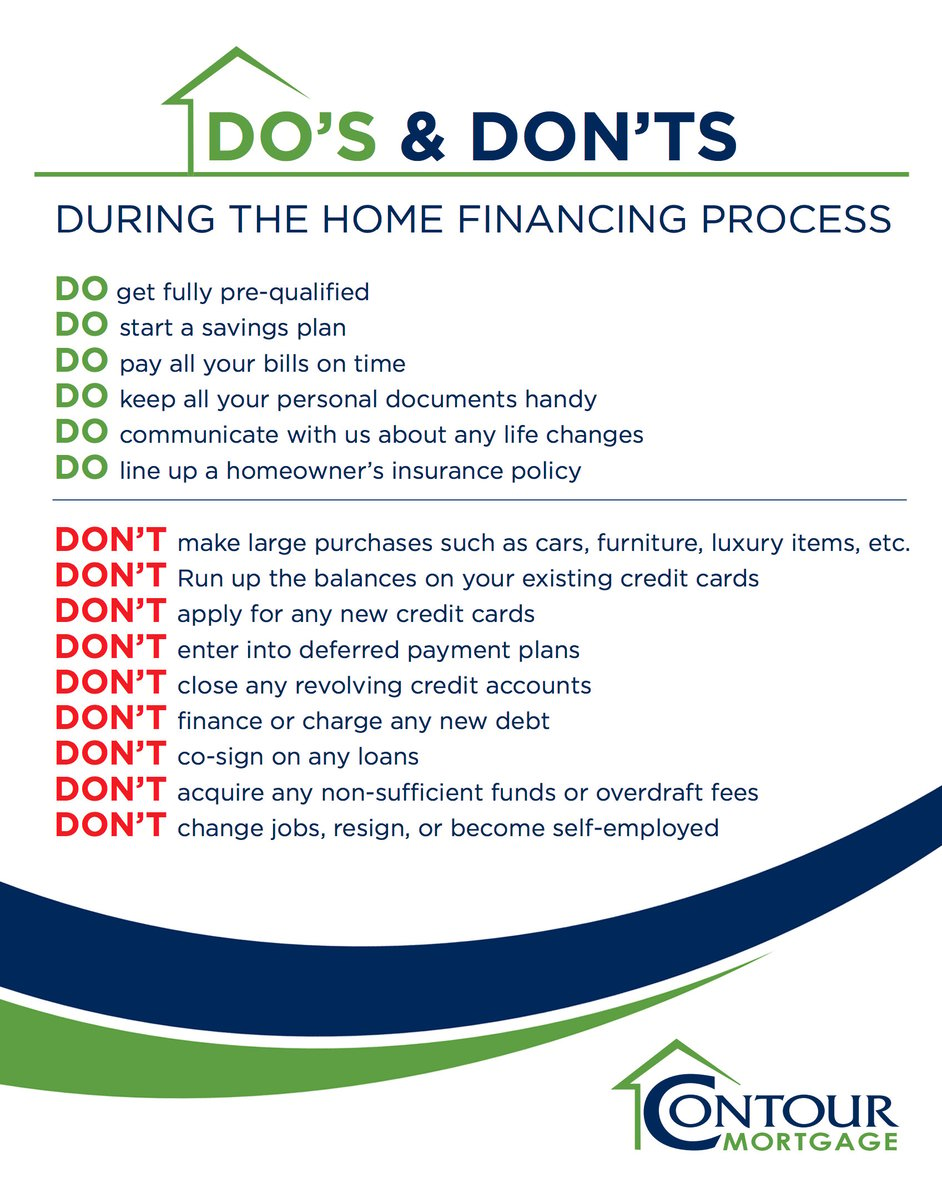

You don’t want to do anything that will jeopardize your chances of getting a loan or purchasing your dream home, so here is a list of key mortgage dos and don’ts to consider as you embark on this journey:

Dos:

Get Fully Pre-Qualified

Getting pre-qualified is beneficial for several reasons. For instance, buyers who get pre-qualified before seriously looking for a home will be able to make an offer as soon as they find the right property. This improves their profiles to sellers, and gives them more of a chance of landing the home they really want.

Start a Savings Plan

Mapping out how much money you need to save will make it easier for you to afford a home. Plus, it will make your dream of homeownership seem that much more attainable, as you will be able to visually see how much money you have to put away each month to achieve your goal.

Pay All Your Bills on Time

It’s important to continue to pay your bills on time and in full, if possible. This will help keep you out of debt and improve your credit score, which will only work in your favor when you go to apply for a mortgage loan.

Keep All Your Personal Documents Handy

When you apply for a mortgage pre-qualification, you are going to need to provide specific documentation. This includes your tax returns and W2s from the past two years, proof of employment, your last two paystubs, and your last two months of bank statements. It's therefore imperative to collect and organize this information so you are prepared when your lender asks for it.

Communicate With Us About Any Life Changes

Any life changes that will affect you financially should be discussed with your mortgage lender. If you've unexpectedly lost your job, for example, your lender will want to hear about it because it could impact the type of loans you qualify and/or change your budget.

Line Up a Homeowner's Insurance Policy

Homeowners insurance covers certain losses that may occur to a residential property, whether due to an accident and/or storm damage, such as fires, snowstorms, and burglaries. This may include harm done to the home itself, as well as items inside.

Each insurance policy differs from person to person, as pointed out by Allstate. The insurance company reveals, "While a typical policy comes with certain coverages, it's usually customized to meet each individual homeowner's unique needs."

Don’ts:

Make Any Large Purchases, Such as Cars, Furniture, Luxury Items, Etc.

Buying such big-ticket items could mess with your debt-to-income ratio, which jeopardizes your chances of obtaining the mortgage loan you want. This is why many lenders will advise their clients to cease from making these kinds of purchases until after the closing.

Run Up the Balances On Your Existing Credit Cards

As discussed in a November 2017 article by The Balance, an online financial resource, running up the balance on a credit card does more harm than good. Among other adverse effects, it can make your credit score drop by 10 to 45 points and increase your risk of going into debt.

Apply For Any New Credit Cards

Mortgage lenders run a client’s credit sometimes 10 days or so before a closing. If new accounts show up on the check, it could impact whether or not that person still qualifies for a loan.

Enter Into Deferred Payment Plans

Deferred payment plans delay the payment of a purchase or loan. While you may have already deferred a student or car loan, for instance, before you began the home-financing process, it's not something you want to do right in the middle of it.

Close Any Revolving Credit Accounts

As aforementioned, you’re going to need to show your lender your bank statements and credit report from the last two months. Doing so gives the lender an idea of whether or not you have enough money to cover a down payment and closing costs, which plays a role in how large of a loan you qualify for. As a result, if you already get approved for a mortgage loan and then change or close any credit accounts afterwards, you’ll have to provide this information again since circumstances have now changed. This will cost you more time, and maybe even a property you had your eye on.

Finance Or Charge Any New Debt

If you’re already pre-qualified for a mortgage loan, your lender is going to have to re-evaluate your credentials, as the initial pre-qualification was based off your previous debt-to-income ratio.

Co-Sign on Any Loans

Co-signing on a loan makes you responsible for any debt the borrower is unable to pay. Similar to our last point, this puts you at a greater risk of going into debt, which could hurt your changes of obtaining a mortgage loan.

Acquire Any Non-Sufficient Funds Or Overdraft Fees

Repeatedly acquiring non-sufficient funds or overdraft fees could hurt your credit score because it indicates that you are spending more money than you actually have. This won't look good to a mortgage lender because we want to know that you will be able to pay back a loan without issue.

Change Jobs, Resign, or Become Self-Employed

Making any changes to your employment affects your debt-to-income ratio. Plus, providing proof of employment is a typical requirement when applying for a mortgage. Your lender will likely verify this information, so it can get complicated, especially if you don’t communicate what’s going on. However, if you’re really interested in getting another job, either find it before you start the home-financing process, or wait until you’ve officially bought a property to accept another position.

Now you are armed with some suggestions to make your home-buying journey successful and less stressful! So relax and let the Contour Mortgage team do the work! We are here to help and answer any questions you may have.